The events of the future are unknown, but The Future is an old friend: we’ve seen it come and go before.

First, new horizons appear. The lookout in the ship’s crow’s nest sights a new continent. Astronauts witness the dark side of the moon. But then the horizons blacken. The new continent is despoiled and pillaged. The moon asks the astronauts “you’re here. Now what?” The unknown turns ugly very quickly, as a piece of paper burns from the edges in.

A theme in science fiction (emphasized in the New Wave of the 1970s) is that we might not know what to do with the discoveries of the future: that our wings will burn away, and then we’ll fall. Stanley Kubrick’s 1968 film 2001: A Space Odyssey took a less (or perhaps more) pessimistic approach, the future will change us so that we cannot fall. Evolution will alchemize us: the primitive shaggy apes are doomed, and though their descendants will succeed in the new world, they are not their descendants. Will we live or die in the future? Maybe it’s not simple. Maybe we’ll be different.

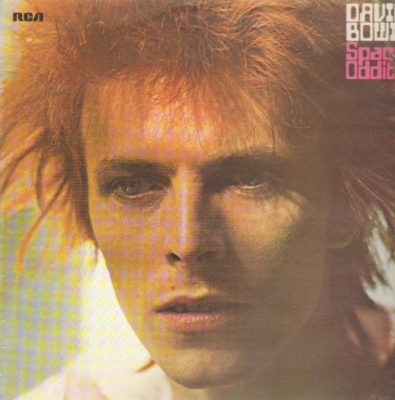

David Bowie saw the film while stoned, and it excited him terribly (interesting coincidence: the astronaut in the film is called “Dave Bowman”). His career was bouncing along like a dead cat at the time – failed bands, a dead-on-arrival album in 1967, and no real musical identity. His manager Ken Pitt was wearily cobbling together a promotional film (the unreleased Love You Till Tuesday), and he needed a filler track. Bowie wrote “Space Oddity”.

Forty four years later, it is Bowie’s signature song. It was performed in space by Chris Hadfield, four hundred kilometers above the earth’s surface. Unlike the apes, the humans, and Bowie himself, “Space Oddity” might never die. It has been selected for quasi-immortality. Nothing about the song makes sense. It’s a filler that will live forever; a tonally complex piece (with fifteen different chords) that can be strummed in basic outline by any starting guitarist; a musically indecisive song (neither sounding like folk or rock) that captures an era and a career. I’m still not sure what to make of it, but clearly we have to make something. It will outlive us, too.

The song’s minor success upon release (it was used by the BBC to score footage of the Apollo 11 moon landing – nobody seems to have realised that the song ends with the astronaut stranded in space!) led to a rushed album, initially self-titled, then rebranded as Space Oddity.

It’s not an unreserved classic. It’s confused at times, as if part of it still exists in imagination, and was imperfectly drawn into reality. The songs are mostly longwinded and complex, and the band doesn’t sound as tight as it needs to be. Tony Visconti’s solution was to slather everything in reverb and room noise, leaving Bowie’s vocal track to hold things together.

Although there’s only one outright bad song – the hideous “God Knows I’m Good” – it’s a frustrating listen at times, sometimes underdeveloped, and sometimes over-egged. Tracks like “Letter to Hermione” are so thin they can hardly stand upright, while “Unwashed and Somewhat Dazed” and “Cygnet Committee” struggle not to collapse under their weight. I want to run a butter knife over it, and smooth all the clumpy parts.

But Space Oddity is obviously a start for him. You can see where “Cygnet Committee” ends and “Savior Machine” begins, for example. There’s moments of real artistry: “Memory of a Free Festival” begins as a pile of indistinct musical fog, and just when you’re good and lost, a ship’s prow pierces the mist. You can hear the song make sense of its own confusion, and it’s one of the finer moments of the album. The album’s lyrics are mostly confessional in nature, which isn’t something we saw a lot of before or after. A lot of it’s about disillusionment. “Letter to Hermione,” “Cygnet Committee”, and “Wild-Eyed Boy from Freecloud” are kiss-offs to various relationships and social cliques Bowie was a part of.

Although it lives in the shadow of its very famous track, there’s much of interest here. I would not recommend this as a first Bowie album for anyone, and it might be best as their last: when one’s deep enough in the game to wonder where he came from and how he got to the present. If you want evolutionary steps, this is where we see vestigial legs appearing on Bowie. It’s very spacey, very odd, and very worthwhile.

No Comments »

(Note from management: review is terrible. We estimate that it will be demolished and a better one built by no later than 2039, allowing for cost overruns.)

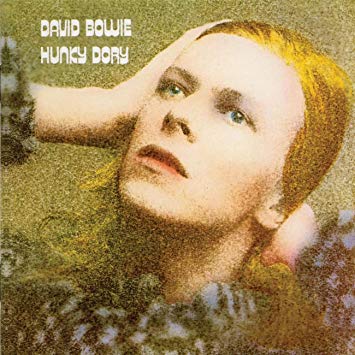

Here’s where Bowie really gets his shit together. “He already had his shit together on TMWSTW!” Yes, but here he gets his shit even more together. Imagine a 10,000-psi hydraulic shit-compactor that compresses the entire contents of David Bowie’s lower bowel into a one-inch cube. That’s how together his shit is on this album.

Hunky Dory is a lovely collection of music, a classic among classics. Pick a Bowie fan, and ask for their ten favorite songs. I guarantee that at least two and probably three songs mentioned will be from Hunky Dory. (For the sake of sample purity, ignore any female whose answers contains “Magic Dance”.) “Changes”, “Oh! You Pretty Things”, “Life on Mars?”…they just keep on coming, to the point of embarrassment. Damn it, David, you’re supposed give the rubes one good song, and then unload the filler. You’re not supposed to pile up like, four or five classics on each side!

Books could and have been written about why these songs remain listenable and timeless in the face of (ch-ch-)change, bur some of Hunky Dory’s finest moments occur in the the deep cuts. “Andy Warhol” is a song nobody talks about much, and it didn’t place at all in Chris O’Leary’s 2015 Bowie song poll. Yet it contains Mick Ronson’s greatest riff, a jagging, colorful flamenco line that was later borrowed by Metallica for the bridge to “Master of Puppets”. Bowie performed the song personally to Warhol at the Factory in September 1971 – apparently, Warhol completely ignored the song he’d just heard, and commented on Bowie’s shoes!

“Queen Bitch” rips off Velvet Underground and takes them to a new level of violence, pounding the listener into a bloody pulp. But the greatest moment arrives at the very end of the album, with “The Bewlay Brothers”. The song is part acoustic folk, part studio experiment, with a mysterious set of lyrics that fans have spent five decades trying to tease apart.

Bowie would trash the song as portentous nonsense in interviews. But there’s something obviously personal about “Bewlay Brothers”, as if there’s real feelings underneath the fanciful patina of dwarves and rituals. For example, “My brother lays upon the rocks/he could be dead, he could be not” could only refer to Bowie’s schizophrenic half-brother Terry Burns, whose seizures would cause him to collapse in public. Bowie’s disavowals seem like an attempt to cordon off the song, and stop people from looking at it. As a man who traded in identities as much as any spy, did he slip up on this one, and reveal the truth?

Hunky Dory‘s weakness might be the production and presentation. Tony’s Visconti’s absence behind the mixing desk is a pretty big deficit: the instrumentation sounds thin. And although the pacing plays some fun tricks (the unresolved tension at the end of “Oh! You Pretty Things” gets cleared up straight away by the F in “Eight Line Poem”) overall the album seems misweighted, with a foppish, baroque first half and a hard rocking second half.

Although it’s only my fourth favorite Bowie album (behind Low, Station to Station, and Aladdin Sane…or damn it, maybe Diamond Dogs?), it’s the one with the catchiest songs. Bowie ruled the 70s like the Beatles ruled the 60s, but if you were to shave his career to the very finest point, it would start with “I still don’t know what I was waiting for” and end with “…malio”.

No Comments »

Tonight is widely regarded as the album where Bowie musically fell apart. It is widely regarded correctly.

It puts its best foot forward with “Loving the Alien”, which aspires to be next David Bowie Classic. Yes, move over “Heroes” and “Rebel Rebel”, it’s time for “Loving the Alien”. Does it live up to its ambitions? What do you think? Of course it fucking doesn’t! The production is smothering, the arrangement uninspired, the melodies rancid. The pre-chorus tries to build, but there’s nothing to build from, nowhere to build to. Guitars and glockenspiels and xylophones lurch upwards in awkward quintuplets…then the chorus arrives, at which point everything goes crash on the floor.

The lyrics attempt a grand statement about peace and unity but come off as another white millionaire wondering why all those brown people in the desert don’t try not killing each other. Seven minutes later, the song ends. It’s self-conscious, tries too hard, and just isn’t good.

He phones it in for the rest of the album, and the line’s engaged. “Blue Jean” is catchy and comes off well, although the xylophonist deserves a beating. The rest of the songs just suck, unless you like Phil Collins. The only saving grace is that Bowie is barely on it.

Let’s get that out of the way, too. He plays no instruments, the tracks are propped up with backing vocals and guest performers, and only two tracks are solely credited to him. Five covers on a nine track album, if you please, padding it out to a whopping thirty five minutes. This is the second shortest Bowie album ever released (after Lodger). You could put the entire thing on a 33RPM record, and have enough space a quarter of Aladdin Sane, or “Station to Station” in its entirety. Is Tonight a serious release? It feels more like a posthumous album. It’s as if Bowie died in 1983, and his label went fishing through his rubbish bin for tapes.

I have no more words to say. It’s like reviewing a box of empty air. Call me crazy, but I actually expect David Bowie albums to have David Bowie on them.

No Comments »